Contact Us

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.

November 9th, 2022

s private equity funds draw on a wider variety of levers to grow their investments, they are under pressure to show compliance, best practices, and performance against a range of metrics. As leadership becomes a key value-creation driver, demonstrating control over leadership sustainability is moving up the agenda.

Economic uncertainty and rising caution around new deals mean many private equity firms are turning their focus inwards, towards their current portfolio. Almost every sector will face a more challenging environment in the coming 12 months – if they aren’t already - so now is the time to ensure portfolio companies are in the best position to confront obstacles, mitigate risks, and ultimately stay on course for growth.

Sustainability has become a buzzword in private equity, with investors keen to deliver both sustainable returns and sustainable business models, while upholding their ESG (environmental, social, and governance) responsibilities. Now, as markets tighten, demonstrating control of risk factors across the portfolio is even more critical. And that increasingly extends to leadership, with leadership sustainability becoming a growing priority.

Ongoing leadership evaluation

Leadership diligence regularly happens at the deal stage, or following performance issues, M&A, or other business changes. However it is less common to see it happening on an ongoing basis, as with the analysis of financial and operational performance. This is now changing

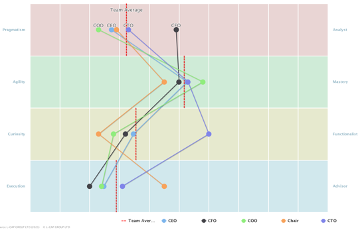

Regular leadership sustainability checks – carried out with minimal leadership disruption – enable PE firms to evaluate the functional, domain, situational and behavioural alignment of a leadership team, as part of their routine management processes. Doing so helps investors to regularly optimise the team for value creation, and proactively manage risks, such as a team becoming backward-looking or being in danger of groupthink. It could even be a way of identifying and mitigating the risk of corporate negligence, like in the case of WeWork, where the CEO was given too much power over leadership appointments.

We liken it to carrying out planned maintenance as opposed to emergency maintenance on a property. By carrying out planned maintenance, you catch issues before they become a serious problem. But if you don’t, then at some point you could end up with a crisis on your hands; for example, you might see a big dip in performance. Regular health checks enable firms to stay on the front foot, minimising risk, while enabling more planned and proactive leadership decisions, ensuring that their succession plans are on track, and the leadership team can flex to new opportunities.

As well as carrying out regular maintenance on individual leadership teams, private equity firms are also starting to track the overall leadership profile of their portfolio, to give an aggregate perspective of its strengths and weaknesses. It may, for example, become apparent that a fund tends to hire a certain type of COO for its portfolio or has a blind spot in one leadership area. GPs can then triage these areas, and perhaps change their approach, or add to their internal expertise to address them.

Benchmarking good governance - reporting to LPs

The other key aspect of leadership sustainability is demonstrating best practices and good governance to LPs. As private equity investors have leaned on a growing variety of value creation levers and come under increasing ESG scrutiny, LPs are demanding more data than ever on the health of the portfolio – and that increasingly includes the strength and suitability of the leadership team.

It wasn’t so long ago that private equity firms would focus almost entirely on financial health when reporting to their backers. But those days are behind us. Firms now deliver a wide variety of information on a quarterly and annual basis, ranging from carbon emissions to diversity targets, and other KPIs relating to each specific business such as risk management or stakeholder engagement.

As leadership analytics have become more sophisticated and readily available, this is now being joined by demand for insights that benchmark the leadership team against both the value creation plan, as well as their peers across the sector. It provides an additional level of transparency in terms of reporting, demonstrating to LPs that the fund is acting responsibly, and is fully in control. Plus, it can be a big selling point when raising new funds.

A new era of leadership best practice

Leadership is so often the elephant in the room in ongoing reporting and governance within PE-backed businesses. It is critical for business sustainability and growth, yet there has never been an accurate and consistent way to quantify and measure leadership stability and effectiveness, beyond looking at historical financial and operational metrics. Now, that’s no longer the case, and firms have a whole new world of leadership data and insights to draw on and drive decision-making. Leadership Dynamics lifts the lid on the top team to aid planning and provide reassurance, - and it is rapidly becoming indispensable.

Whether you're an investor, investee or a part of a leadership team seeking to increase value creation, our strategic consultants are on hand to guide you through your leadership journey. Contact us today.